Allison Ostrander

Director of Risk Tolerance

“When you take a look at the finer details of an option’s strategy, you will see an abundant amount of opportunity while maintaining your risk.”

Who is Allison?

Allison graduated from Stephen F. Austin State University with a Bachelor of Fine Arts degree in Theatre. Wanting to make sure she wasn’t going to be a starving artist while pursuing theatre, Allison took up trading options after seeing her father successfully do the same. What started as an experiment with a paper trading account quickly grew into a passion. She decided to pursue trading full-time while investing in personal coaching classes. As a result, Allison was so successful that she made back her investment in her first trade! After that, there was no looking back.

Fast forward to today, Allison has become an integral part of the Simpler Trading family. With her decade of options trading experience Allison continues to grow as a trader, sharing her knowledge within our community. Her experience in not only trading, but teaching others how to trade, shines through in her videos and blog posts. She has experienced and seen other traders go through the ups and downs of trading. Her goal is to help traders minimize the downs, so their ups can outshine in their account. Allison is able to explain complex trading strategies and chart patterns with ease for both beginners and advanced traders. Her unique view of how to look at Capital Risk, the Chart, and the Option Chain can give any trader a new perspective on investing.

For those who have trouble with position sizing, chart reading, or options trading, Allison’s Recycling Risk sessions are a “must watch.” You can often find her participating in the Simpler Central Room throughout the market day, or catch her outside of market hours teaching classes and hosting member webinars for the Simpler Community.

Where can I find Allison at Simpler?

The Simpler Trading Team is unlike any other. We have 100+ years of combined market experience. While most other services offer ‘hypothetical’ trades and theories, we share our actual trading ideas in real-time.

Becoming consistently profitable with a small account is a challenge most traders fail at due to costly trial and error. We believe the fastest path to success is to follow a proven plan and get ongoing guidance from a seasoned trader who specializes in small accounts. These live trading sessions will allow you to get your questions answered, get up-to-date market insights, and take trades when small account setups form. Small Account Mentorship is for you if you want to learn methods to steadily grow a small account while being surrounded by a like-minded trading community.

Sign Up Now >>

Allison’s Courses

Anticipate how the market will open the next day based on the predictive power of Allison’s formula.

Learn MoreAllison's Trading Plan

- To create an overall growth in my mastery and $500 Challenge accounts each month to pay myself with at the end of the month and also have overall growth in my other accounts by the end of the year.

- To help support myself, my family, and the things I would like to pursue outside of trading

- To test out and discover new options or trading strategies in general that can be used successfully to grow an account.

- To grow an account of long term stock setups for my kids to pass on to them when they are older.

The Profit Recycling Strategy

This is a trading strategy I can use both on intraday moves (without technically triggering the Day Trade Rule) as well as with longer term swing trades. This strategy allows me to help protect capital while still setting up profitable trades to jump into.

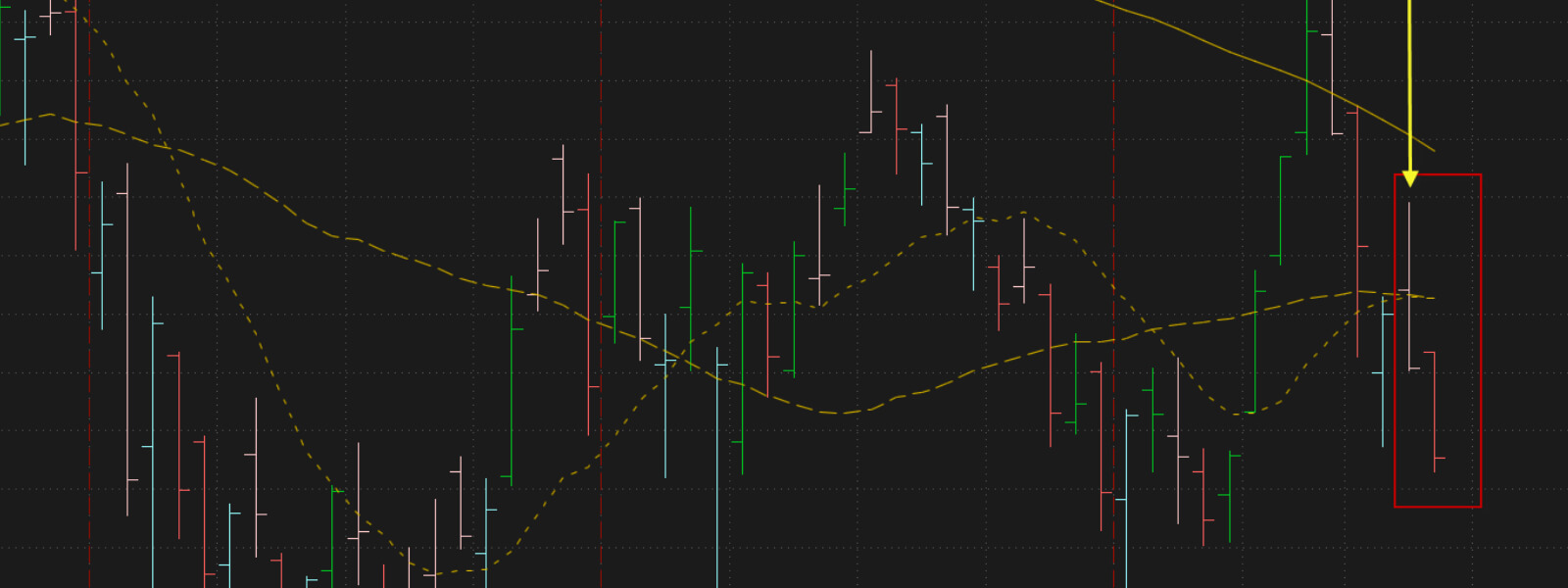

The Overnight Profit Strategy using the Divergent Bar Indicator

This is a great way to take quick short term trades off a Daily Chart that have a high probability of following through. Oftentimes I will use vertical spreads in this strategy to help keep my capital Risk low, but still create great risk vs reward scenarios on the trade itself. This strategy is a great way to keep overall Capital low and not have it sit out too long.

Long Term Swing Trades

These are based on the daily, weekly and or monthly Time Frame using the squeeze indicator as well as the Compound Breakout Tool. When both signals are in line together and with the overall trend, they can create a great set up with a strong possibility of following through. Typically I will look at long calls or shares to jump into. If it is a company like AMZN giving the signal and is too expensive to do in a small account, I will switch the strategy to Verticals, Butterflies, or Diagonals. Most of my long term swing trades stick to a Bullish Trend View.

Compound Butterfly Strategy

These are based primarily on the Daily Chart using the Divergent Bar Indicator, the Compound Breakout Tool, the Simple moving averages, the Bollinger Bands and the Squeeze. Take a combination of different butterflies (depending on the chart setup) to create great risk vs reward trades, but also very forgiving trades of the underlying price movement. This is a great strategy when there are mixed signals on the charts, but you/traders still want to take profits and grow the account.

- My Monthly Goal is to see a positive account move every month so I can pay myself at the end of each month for my mastery and $500 Challenge Accounts.

- In my other accounts, I want to keep a positive yearly target as well. At the end of the Year I also want to take half the profits and lock them in while keeping the rest in my account to continue trading with.

- In the Account for my kids, I am just looking at good buying opportunities to hold long term stocks and I don’t plan to close/pull out any profits in here, but just see overall growth.

Creating positive growth in my account while keeping Risk low using my 25% rule so I never overinvest in my account. This allows me to trade off the technicals rather than my emotions. To do less Earnings-LottoStyle trades this year. Though I find them very fun to jump into, oftentimes, the “big payoff” I am looking for doesn’t happen as I would like and it ends up eating away at my profits overall.

Intraday Time Frames

1 min (only in strong volatile markets, please refer to my Profit Recycling Class to understand when to watch a 1 min time frame, or just ask me in the room), 5 min, 10 min, 30 min and 1 hr.

Daily, Weekly and Monthly

Time Frames For the Overnight Profit Strategy, Compound Butterfly Strategy, and Swing Trades.

Run into Earnings, Standard Squeezes, Pullbacks to SMA’s on Bullish Trends or Bearish Trends, Profit Recycling Intraday Moves (especially in Volatile Markets), end of week pin trades of SPX, AMZN Friday Sell offs, Choppy/Consolidating Trends.

- A Bullish Divergent Bar off Support in a Bullish Trend, or a Bearish Divergent Bar off Resistance of a Bearish Trend, or Back to Back Divergent Bars in a Consolidating Trend.

- A Squeeze and Compound Breakout Tool Signal in line with the Trend.

- A pullback to SMAs as support or resistance with confirmation it is holding.

- If my profit target is hit.

- If there are signs of exhaustion on the Chart with momentum on the Awesome Oscillator.

- Several Days of a Bollinger Band Snap paired with a potential Bearish Divergent Bar (in a Bullish Trend) or a Bullish Divergent Bar (in a Bearish Trend).

- If the chart starts to move outside of the guidelines of my initial trade entry, then I will look to close out of the trade and protect whatever remaining capital is there and look for a new setup.

I am willing to lose 100% of my capital when going into a trade. I define my risk and the Tolerance I hold before getting into the trade. This way I can hold through pullbacks and can be ok if I take a full loss knowing it will not blow out my account.

- Look at the anticipated open and set Closing Orders on Trades I have open if they were not put on the day before.

- Looking for potential squeezes setting up into the day.

- Looking at what symbols have seen strong/volatile premarket moves to consider the Profit Recycling Strategy for Intraday Moves.

- Going through the Simpler Trading Scanner to look for new setups and potential symbols that are not on my watchlist.

- Going into the close of Market, (last 30 mins of trading) I will look for potential Overnight Profit Strategy Trades to jump into.

- Make notes over trades opened, closed or managed that day.

- Makes notes on trades and symbols I am watching but may not have taken action on.

- Prep closing order for trades I have open at my profit target.

Look at overnight, weekly, and monthly levels of standard deviations to ensure the market can provide acceptable risk : reward with my various strategies.

Divergent Bar indicator, Compound Breakout Tool, True Low, Simpler Trading Scanner, and Scanners for the Squeeze.

I have handwritten journals where I take extensive notes throughout the day. At the end of the year, I put all the journals I have gone through together and review them to see where I did well and where I didn’t do well to adjust my trading plan for the next year.

I use Snag It to take screenshots of the charts for Entry and Exit points, as well as take small notes to make on the picture of the screenshot itself. This way, I have both a hand written and digital copy of my notes. In case something happens to one, I have the other for backup. Seeing the actual Entry and Exit from the chart helps me determine if I jumped into a trade based on technical signals or if it was a more emotional trade.

Always continuing to read and listen to the other traders here at Simpler Trading. By talking with them and following their classes I have been able to build up my trading arsenal and combining it with the knowledge I already have, I am able to fine tune my own trading style for more consistent trades.

Discipline & Mindset notes: I will not jump into a trade due to Fear of Missing out (FOMO). I will only do it based on technicals. If it is a good set up but not the best entry, I only do a portion of my normal capital risk to help build into the trade incase of a pullback.

I also always keep at least two to three Brokerage Accounts on at a time. I have found plenty of times through my trading career that one Brokerage platform will be running into technical issues, or slow due to a volatile market. By having at least two accounts open, I have found, I have a much better chance of still being able to trade or jump into a trade if one of the platforms is running into an issue. This allows me to never miss a trade.

Only risk what you are willing to 100% lose not matter the trade. I cannot tell you how many times I have talked to other traders who betted the boat and lost and had no capital left to trade with. This is what helped me develop my 25% rule when it comes to trading, so I never overinvest in my account.

Don’t be greedy. The question I ask myself when I determine if I want to take a profit or not is: “Will I be more upset if I take the profit here and the price moves higher, or will I be more upset if I don’t take the profit here and the signal reverses on me for less of a profit or loss?” Usually I find myself leaning towards the latter. This helps me maintain a positive Winner vs Loser trade ratio and helps me maintain my profits without giving them back.

Don’t trade solely off the news. It is easy to get caught up in the news and let that emotion drive you into or out of a trade. This is a very dangerous way to trade. Unless the technicals are also in line with the sentiment, I would prefer to trade just solely off the technicals. Oftentimes, I have found the technicals are showing you what is about to happen and the News is the Catalyst for that move.

Pay yourself. If you have had a great week of taking profits, pay yourself or keep some cash in the account over the weekend. It is easy to keep jumping in or adding capital because you have been on a winning streak. But there will be losses out there that you take. Don’t give up all your profits because you got ahead of yourself and started to let emotions back into your trading.

It is ok to sit on your hands and wait. It is easy to find yourself wanting to jump into a trade because you are in only a few (or none at all). However, make sure you are doing this off a technical signal rather than just wanting to be in a trade. Sometimes being in cash is a position. And though you may say to yourself you are not making money, you are also not losing any money either. Make sure you take the trade based on your strategy and technicals not because you want to be in a trade.

Trading Platforms Used by Allison:

Recommended Reading

3rd Edition: Mastering the Trade

One of today's most successful traders, John F. Carter has made his popular guide more relevant and effective than ever.

Learn More

A History of the U.S. in Five Crashes

The stories behind five significant stock market crashes in the past century are filled with drama, human foibles, and heroic rescues.

Learn More

The War of Art

A succinct, engaging, and practical guide for succeeding in any creative sphere, The War of Art is nothing less than Sun-Tzu for the soul.

Learn More

Turning Pro: Tap Your Inner Power…

The follow-up to his bestseller The War of Art, Turning Pro navigates the passage from the amateur life to a professional practice.

Learn MoreHere are some of Allison’s favorite products:

Apple iPad

Portable smart devices make it easy to take trading with you. The new iPad combines tremendous capability with unmatched ease of use and versatility.

Buy Now

Keurig Coffee Maker

Simple touch buttons make your brewing experience stress free, and multiple K-Cup pod brew sizes help to ensure you get your perfect cup.

Buy Now

Brooklyn Beans Coffee Pods

Having Coffee on hand and ready is a must for staying awake after being up all night with a newborn. I personally love black flavored coffee like hazelnut.

Buy Now

LEADO 32oz 1Liter Water Bottle

This reminds me to drink water every hour and keep hydrated throughout the day, and of course has that Harry Potter flare to it.

Buy Now

Powerbeats Pro Wireless Earphones

This has been a must have for me during market hours. It allows me to step away from my computer and take care of the kiddos, while still being able to listen for trade alerts as well as the Options Room.

Buy Now

Gaiam Yoga Mat

Being able to just take a mental second from the market and stretch or meditate is a great way to keep your body awake and your mind calm and focused. This is especially true in those volatile minds

Buy Now

Crunchie Chocolate Bar

A guilty pleasure from living overseas in my youth, my favorite candy bar! I much prefer indulging in this vs putting on too many “lotto trades.” Only risk here is added calories to my thighs lol.

Buy Now

Gaming Laptop

This is my current laptop I am using to trade from home as well as when I am on the road. I find gaming laptops can keep up with the live streaming for multiple charts easily, and it also helps that I love playing video games, so it knocks out two birds with one stone.

Buy Now

Asus 21.5” VS228H-P Full HD LED monitor

I am not as particular about being on brand here, as long as it has decent picture quality. When you have at least one extra screen, it can make all the difference in your trading. It allows me to look at multiple charts and my positions page at the same time.

Buy Now

Snack Factory Pretzel Crisps

For a healthier snack, pretzel chips with hummus is a great quick snack while I am watching the market and can be a great pick me up if I have found myself working through lunch.

Buy Now

Media Appearances

Cheddar TV: Tesla Stock Fluctuates on $2 Billion Stock Offering

February 13, 2020

10-minute Stock Trader: Simple Option Trading Risk Management Strategies

Jul 22, 2020